Sell Daily Covered Call

sell daily 0.3% higher than open price OTM covered call within the first 5 minutes of market open and buy back within 10 minutes before market close.

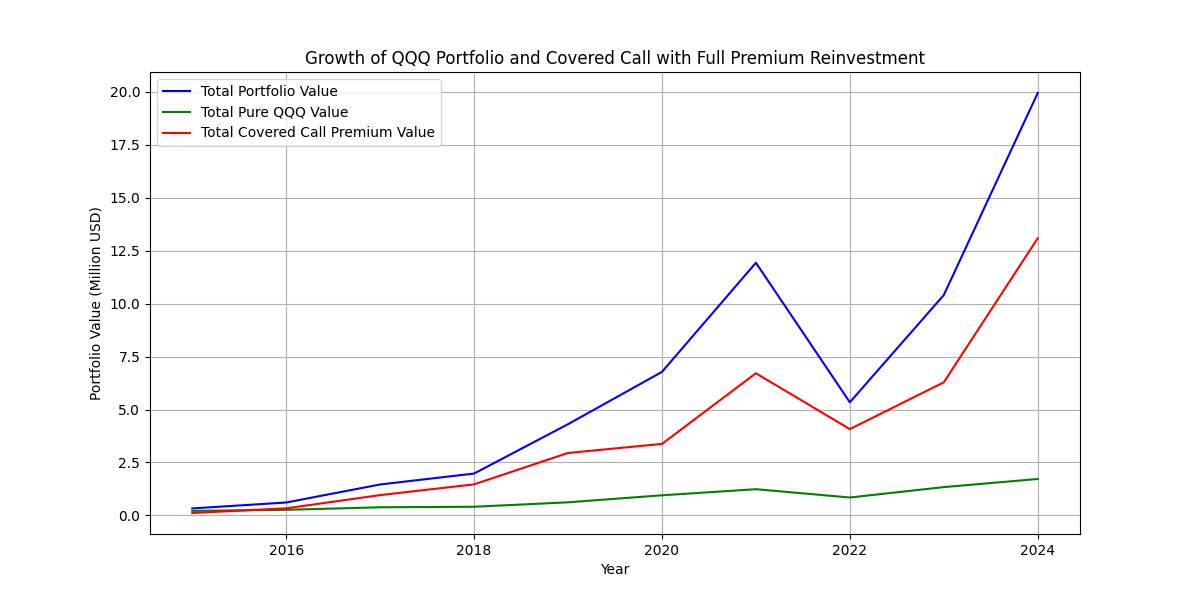

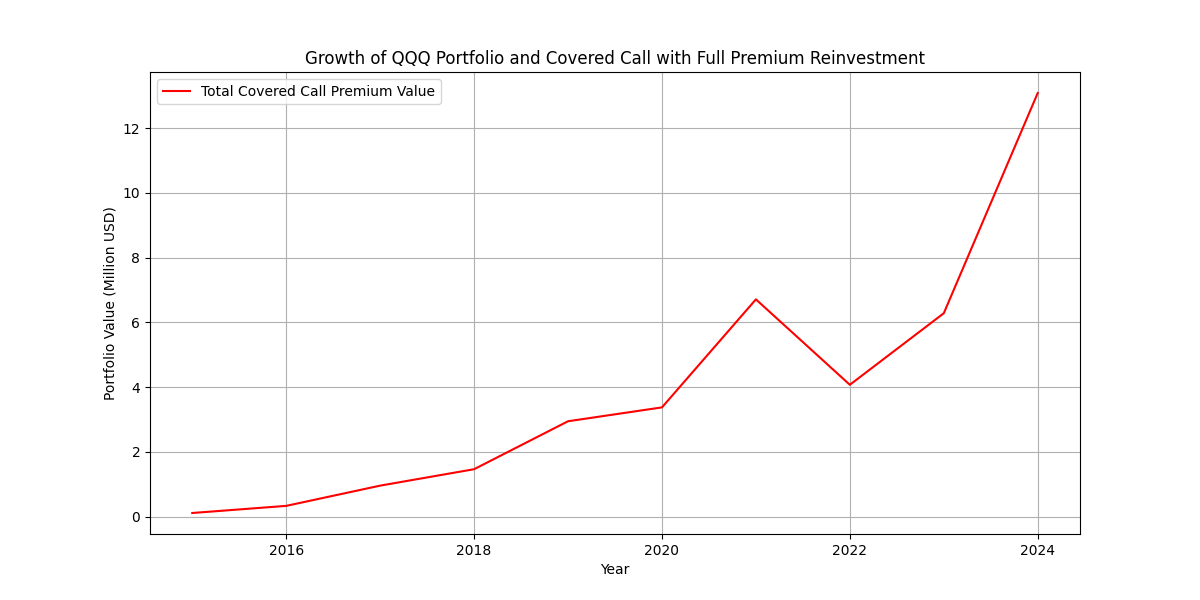

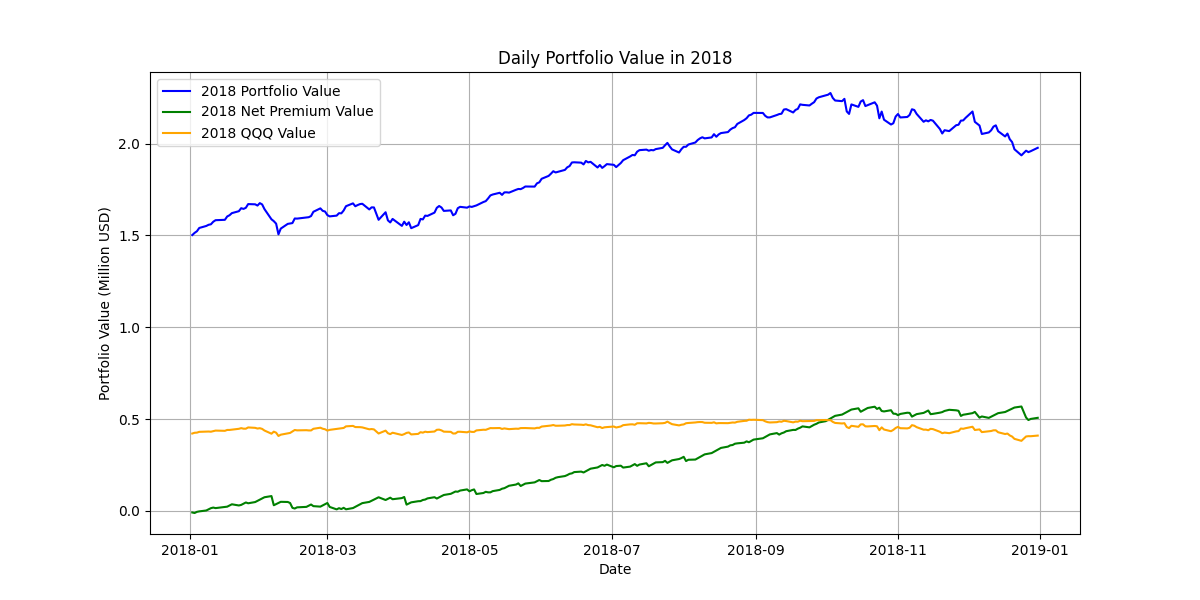

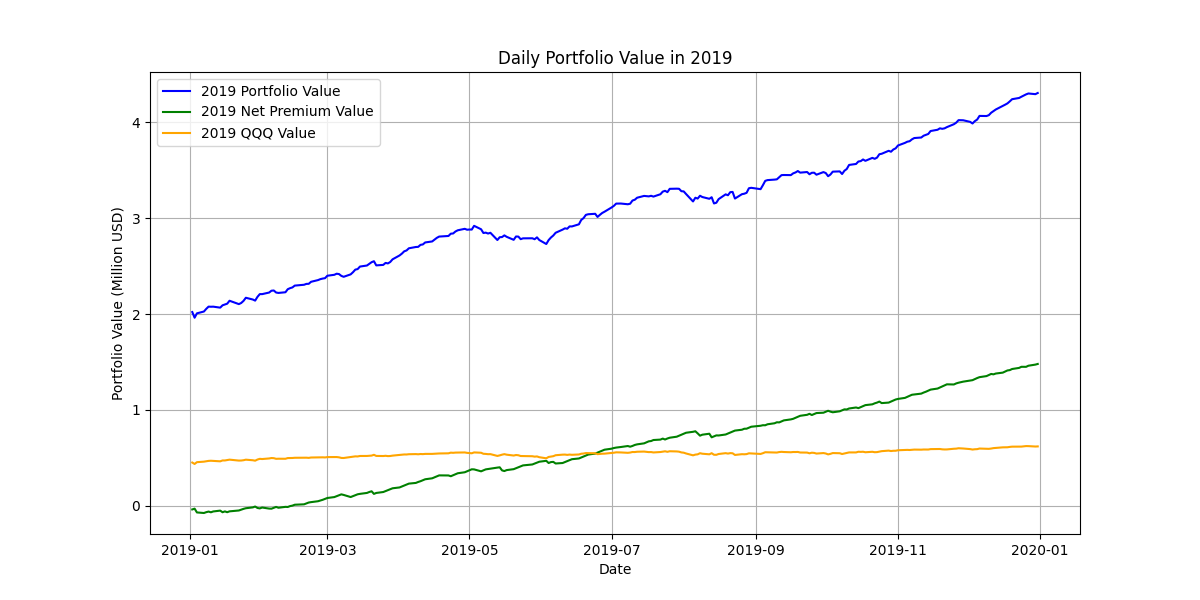

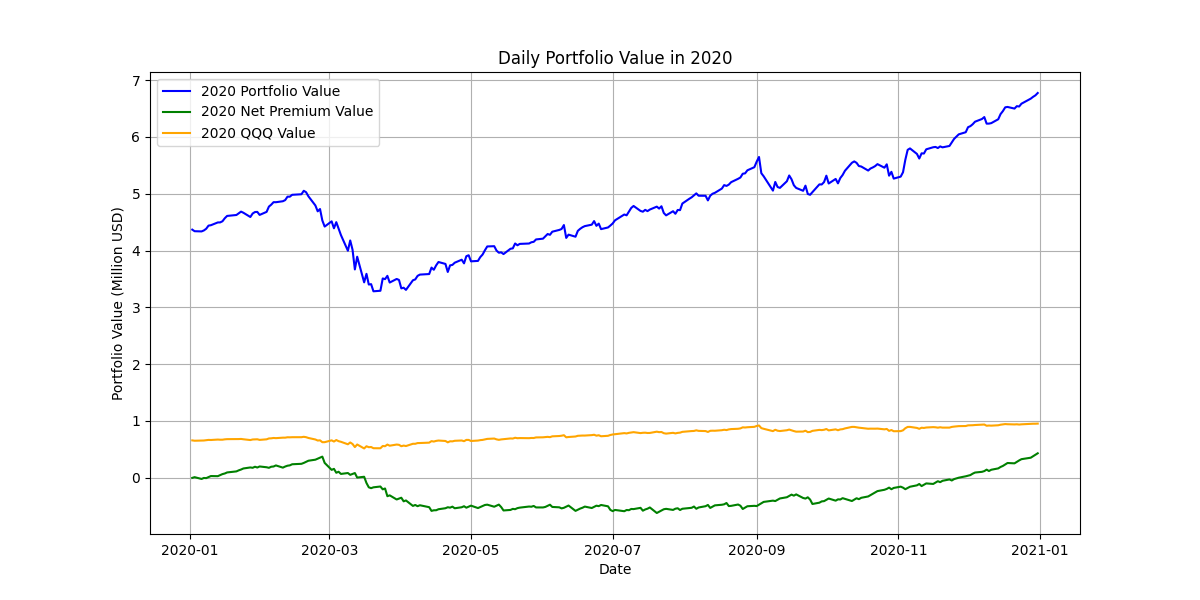

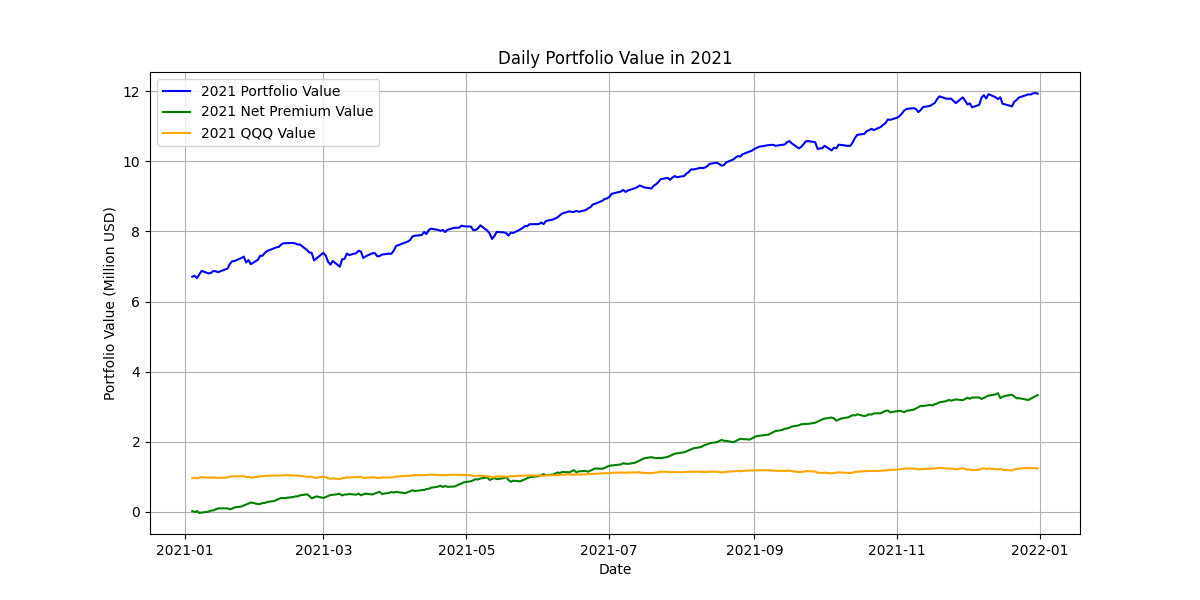

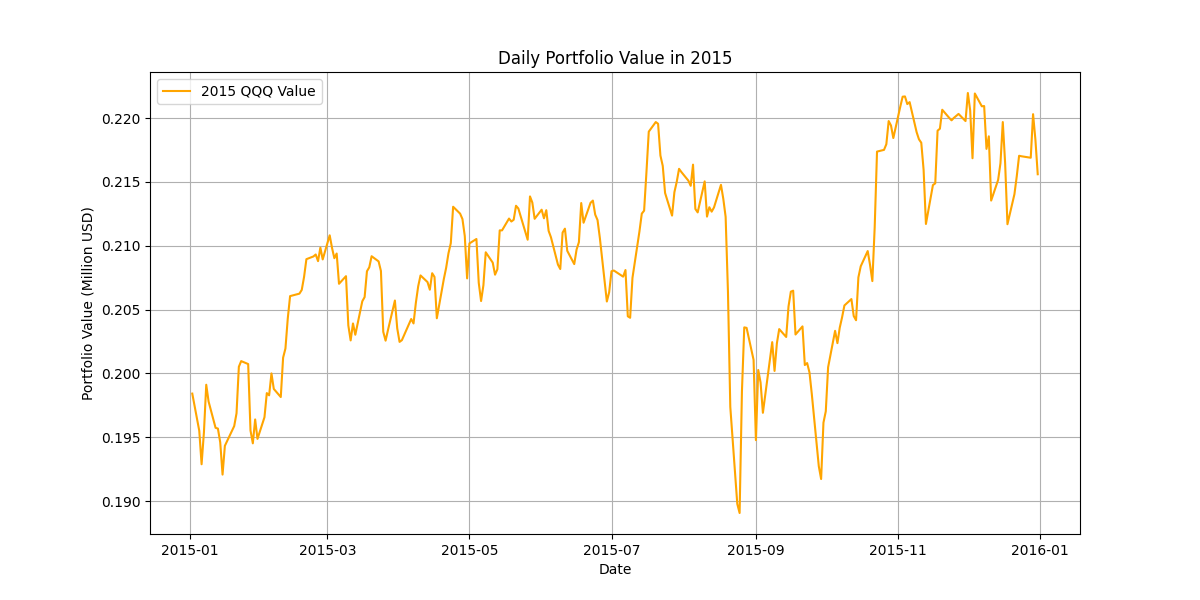

performace from 2015 to 2024

- strategy: buy 200k qqq at the start of 2025, invest last year’s net premium revenue plus 30k each year at beginning.

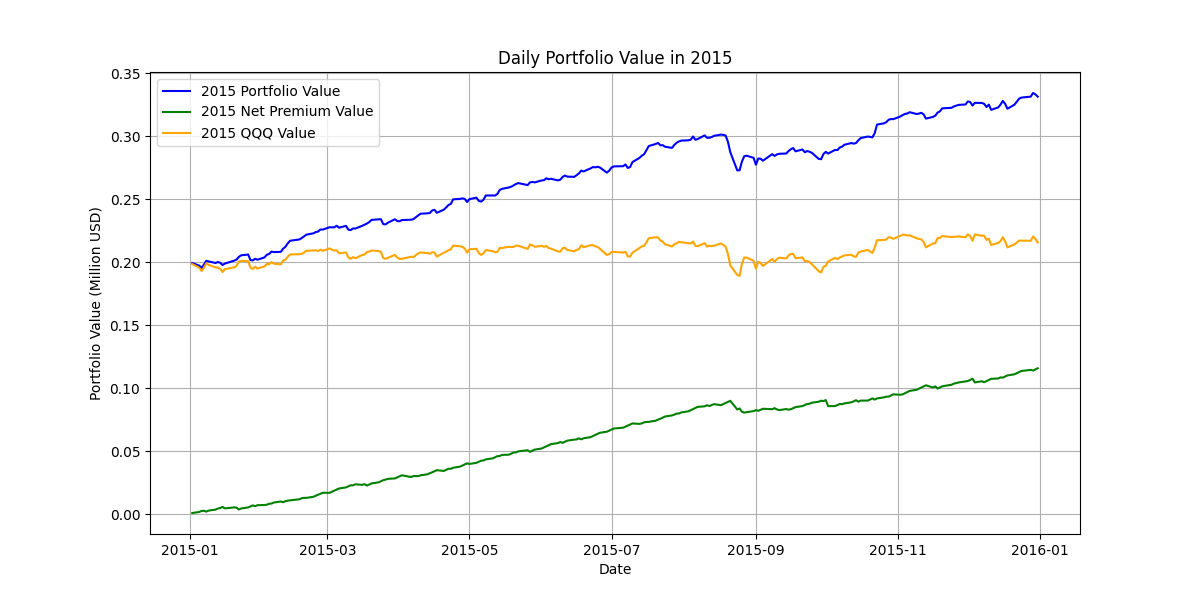

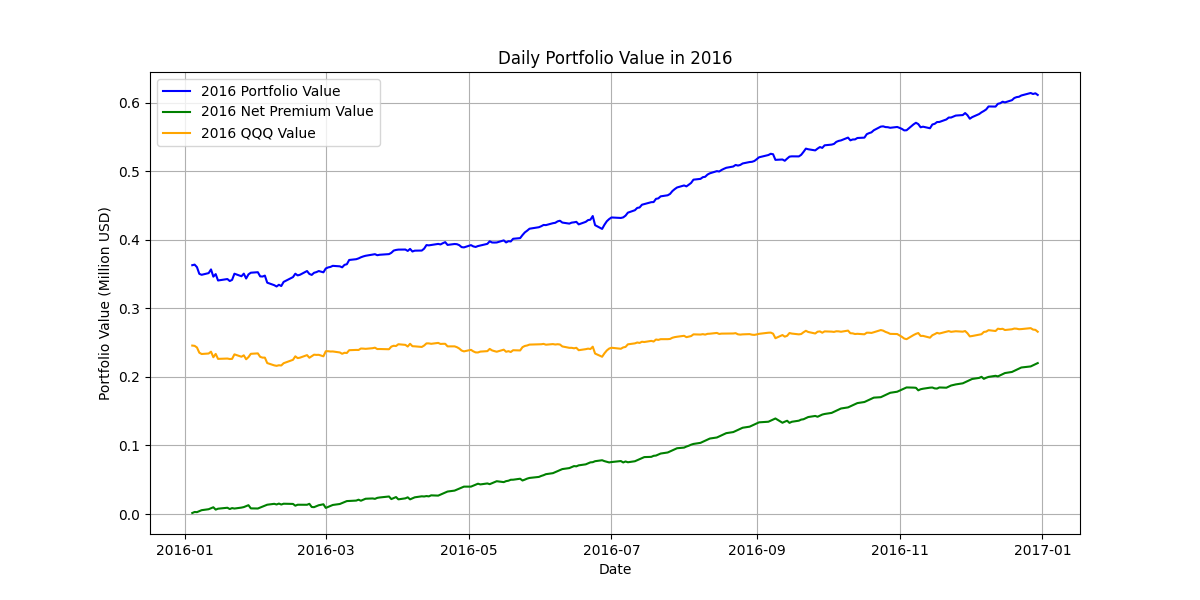

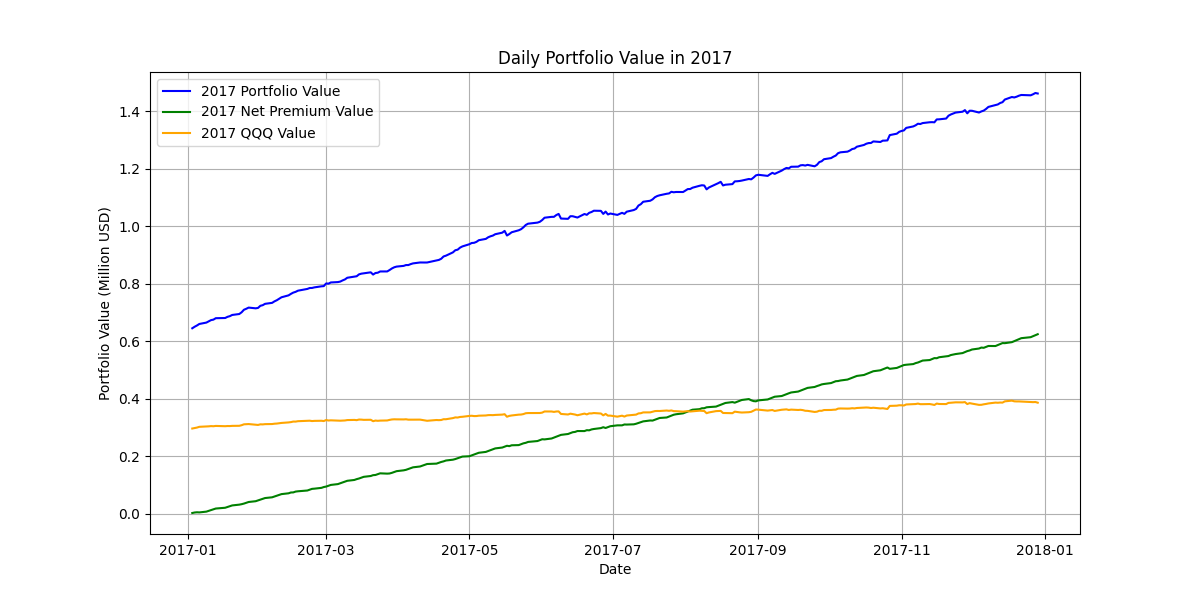

- blue line is the total portfolio with qqq value and call premium reinvestment

- green line is the qqq return without sell calls

- orange line is the sell call net premium return

Thinking

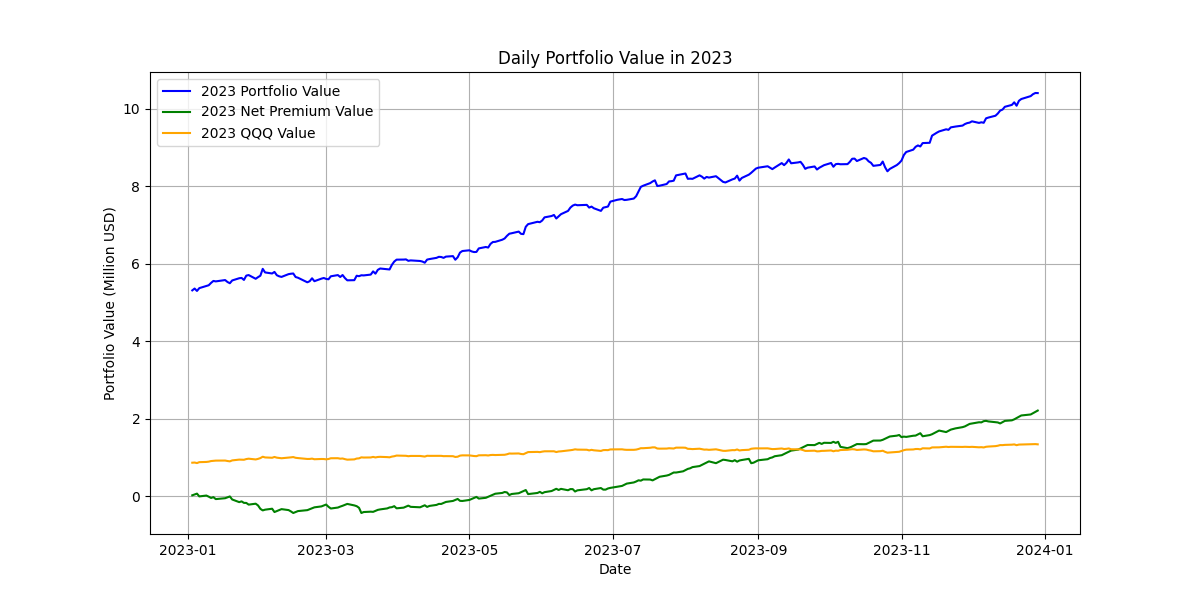

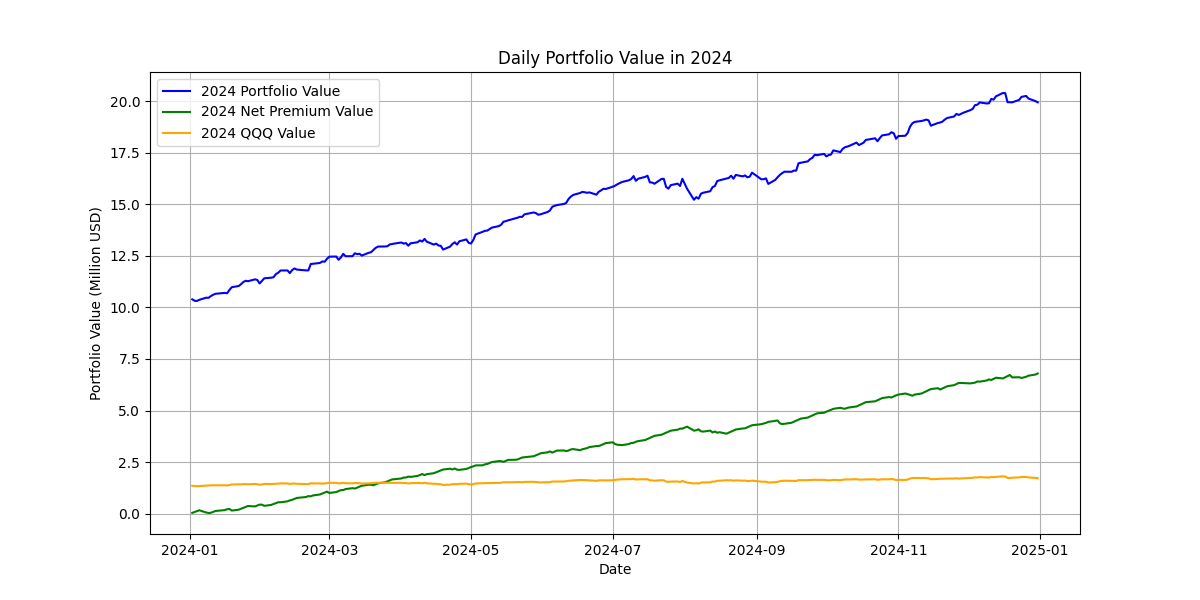

- You could see the power of reinvest of call premium into qqq stock.

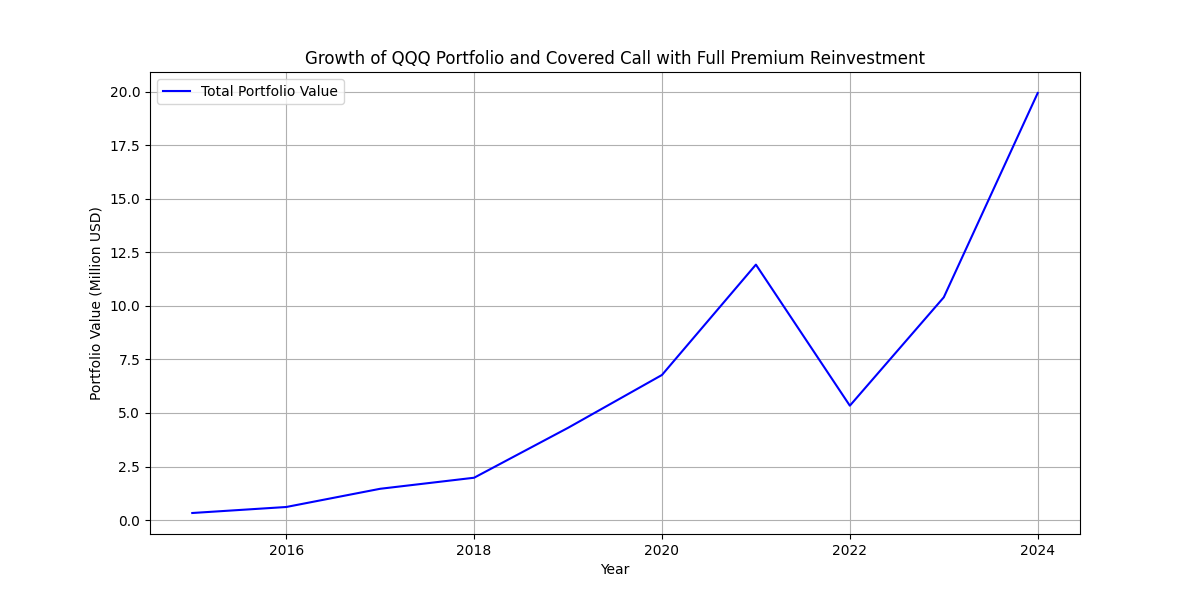

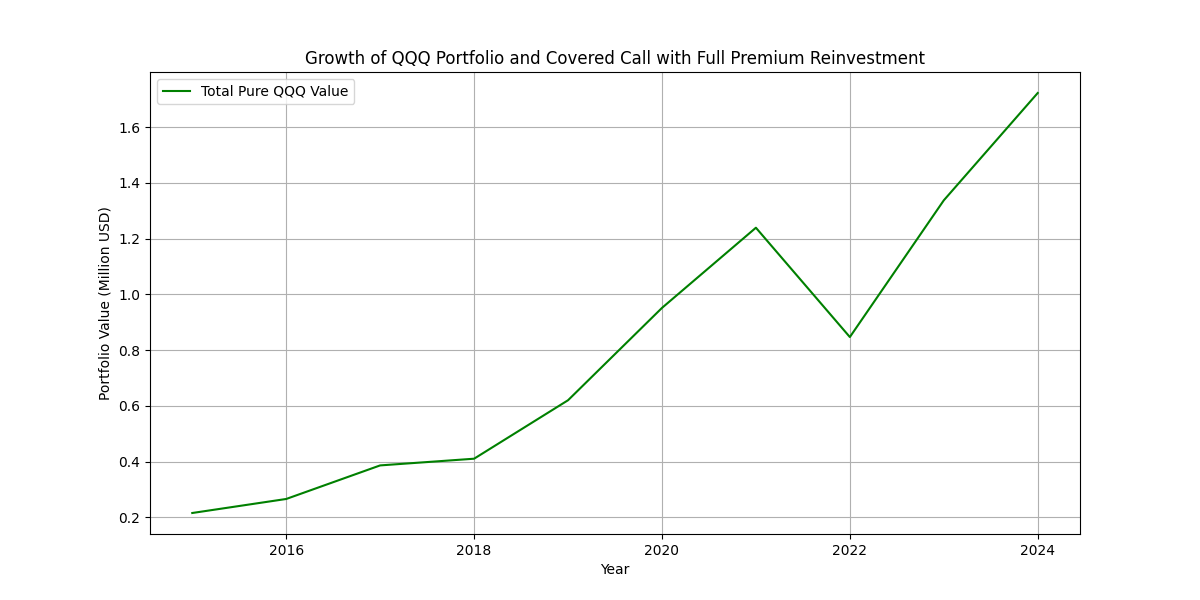

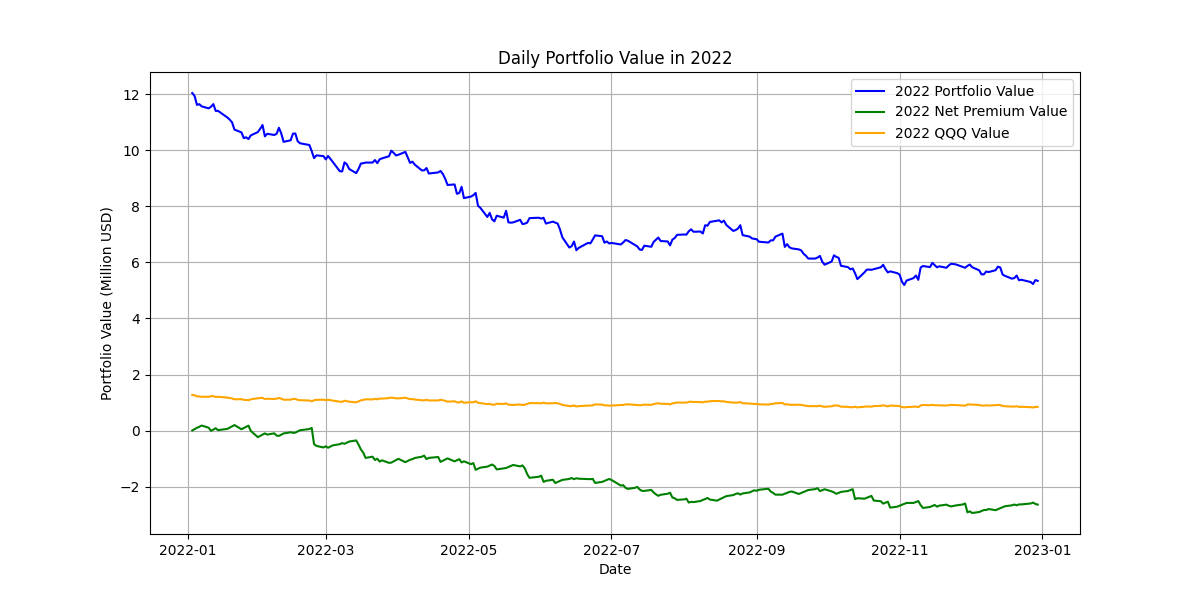

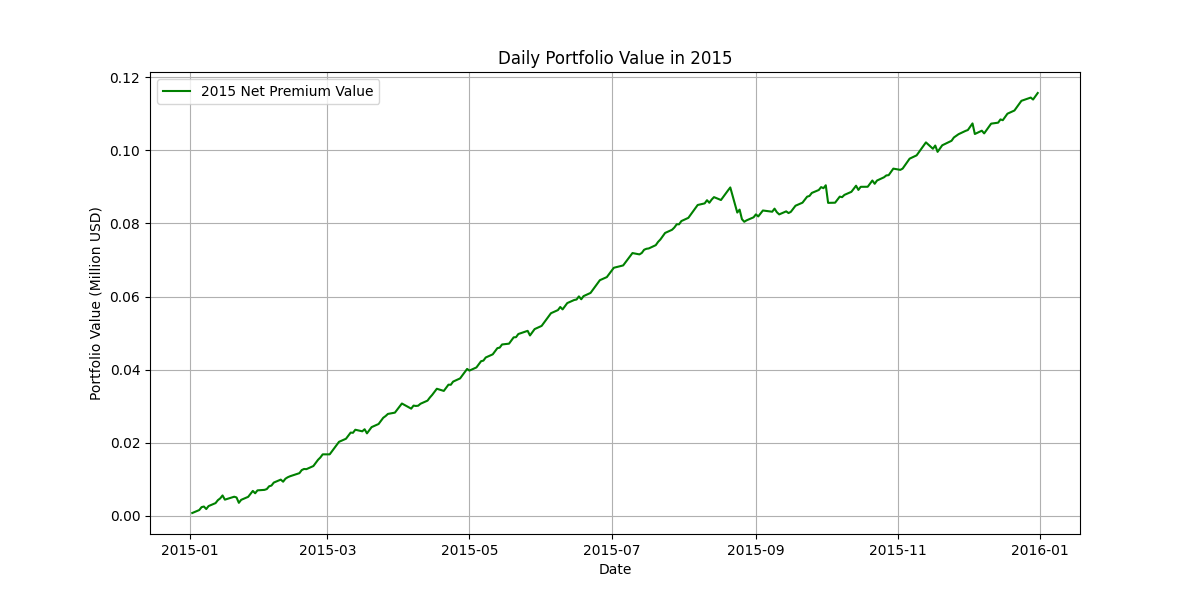

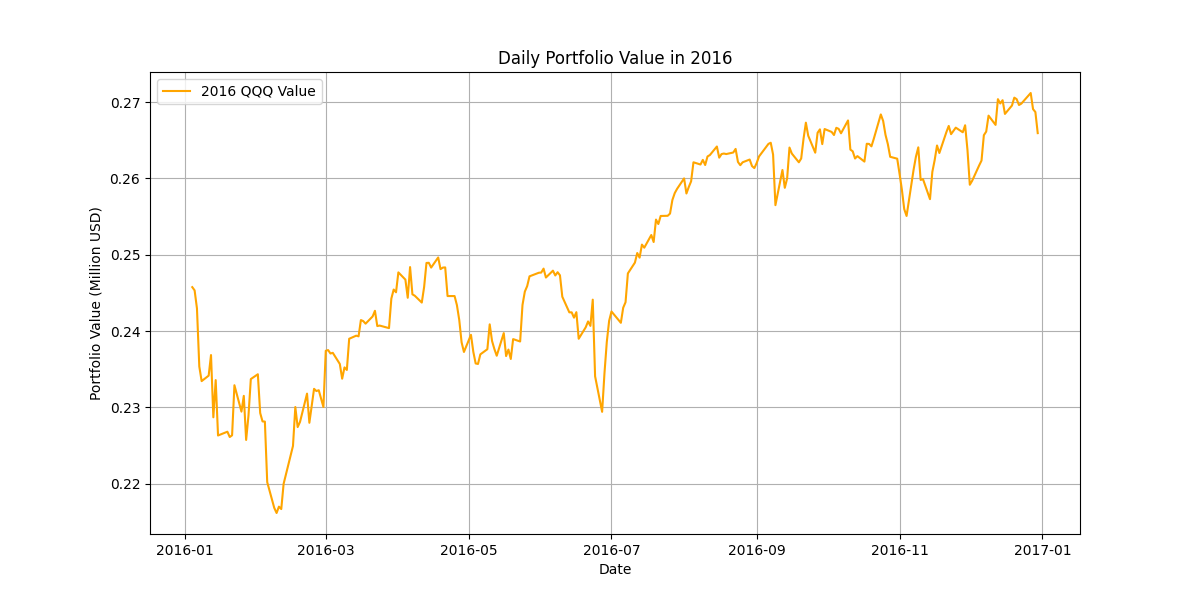

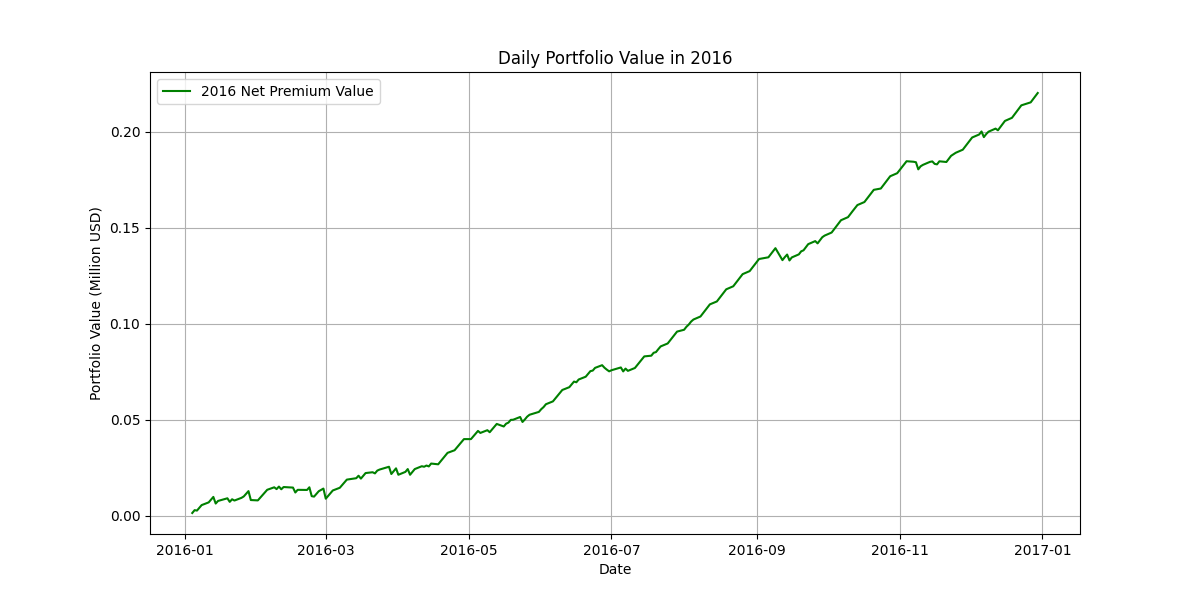

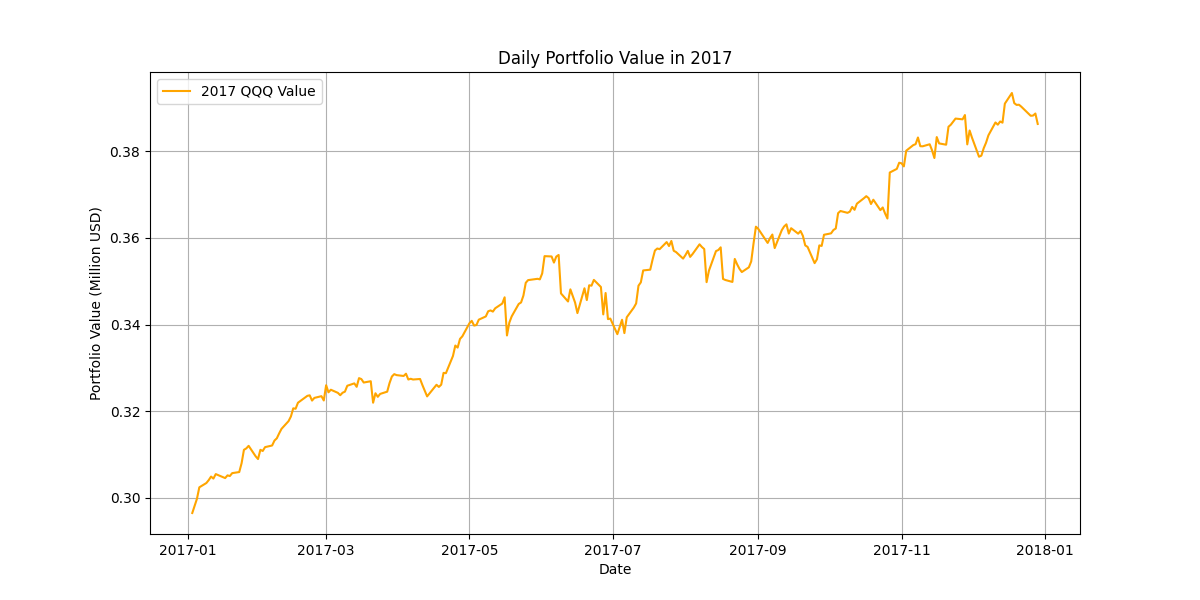

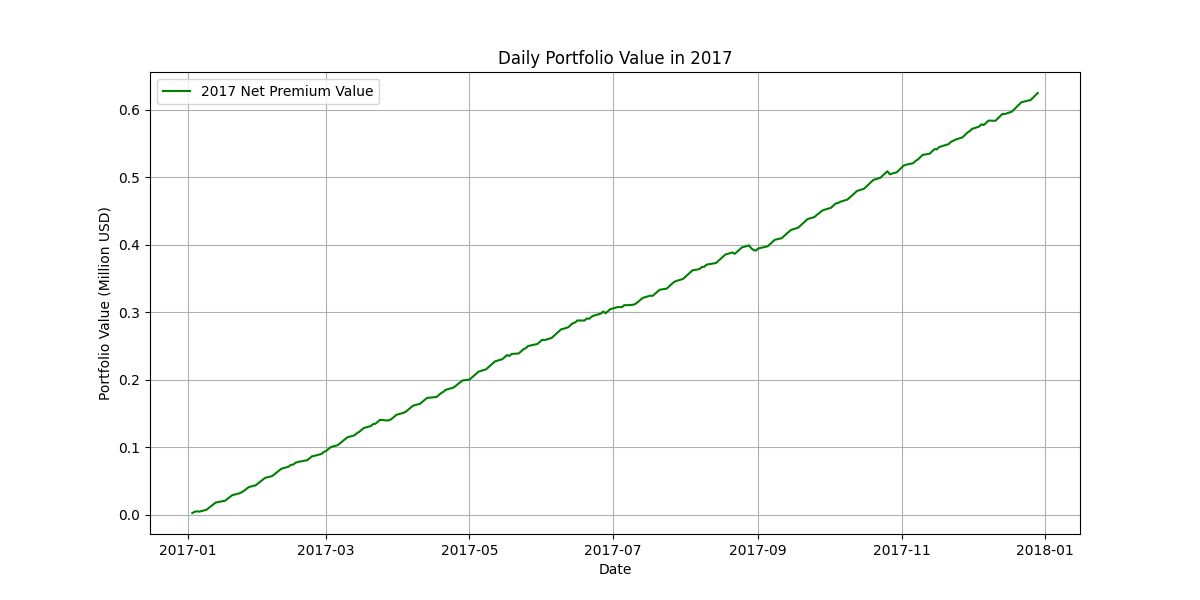

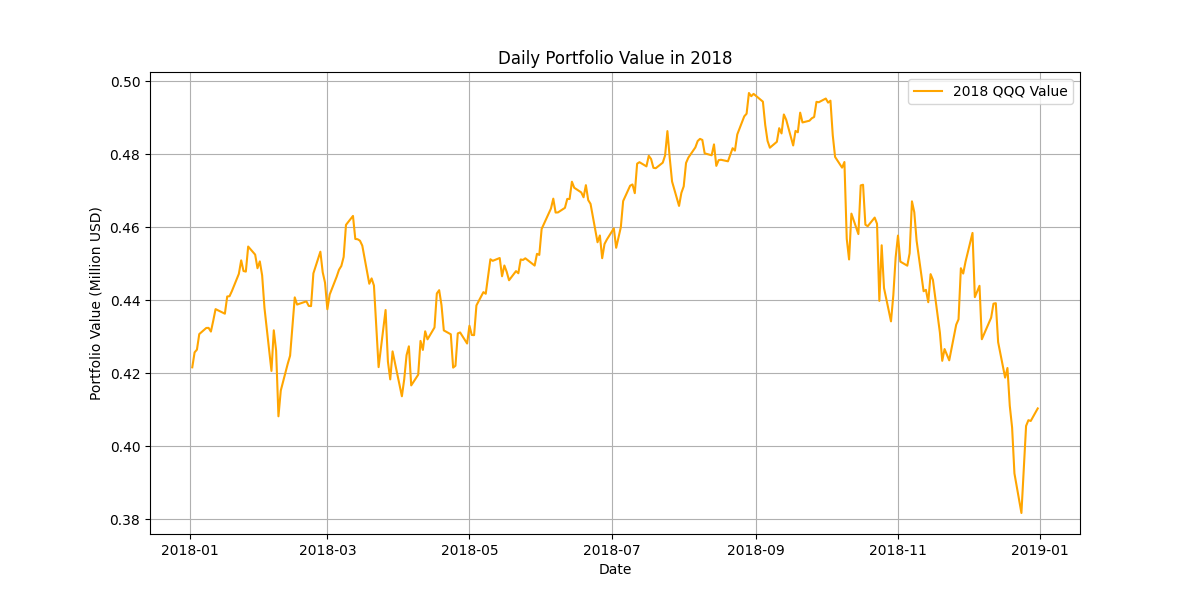

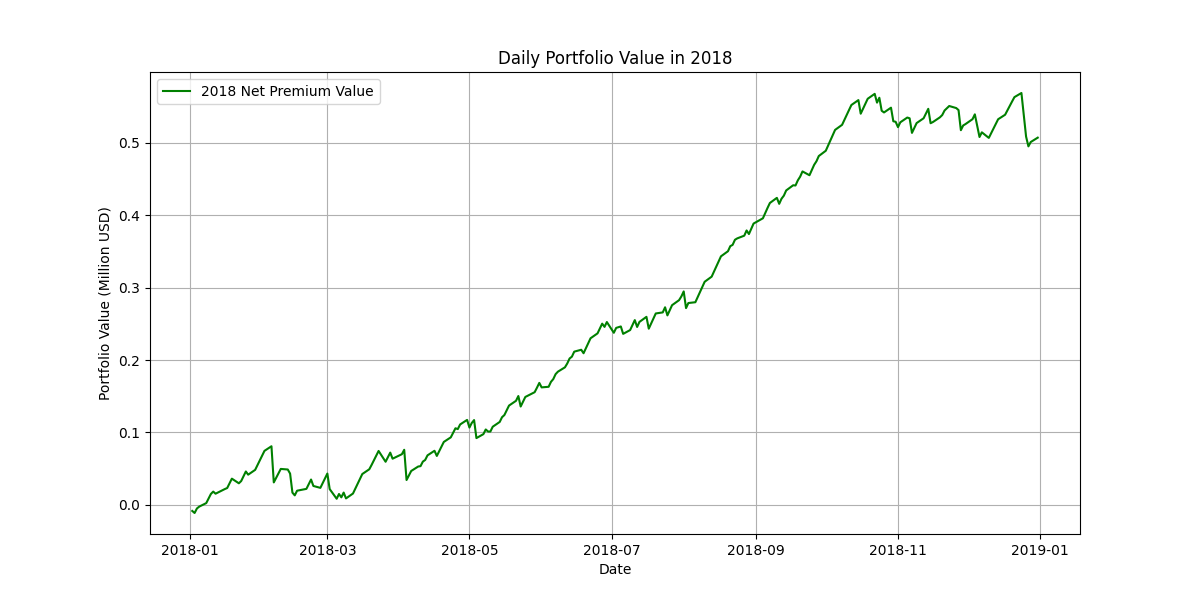

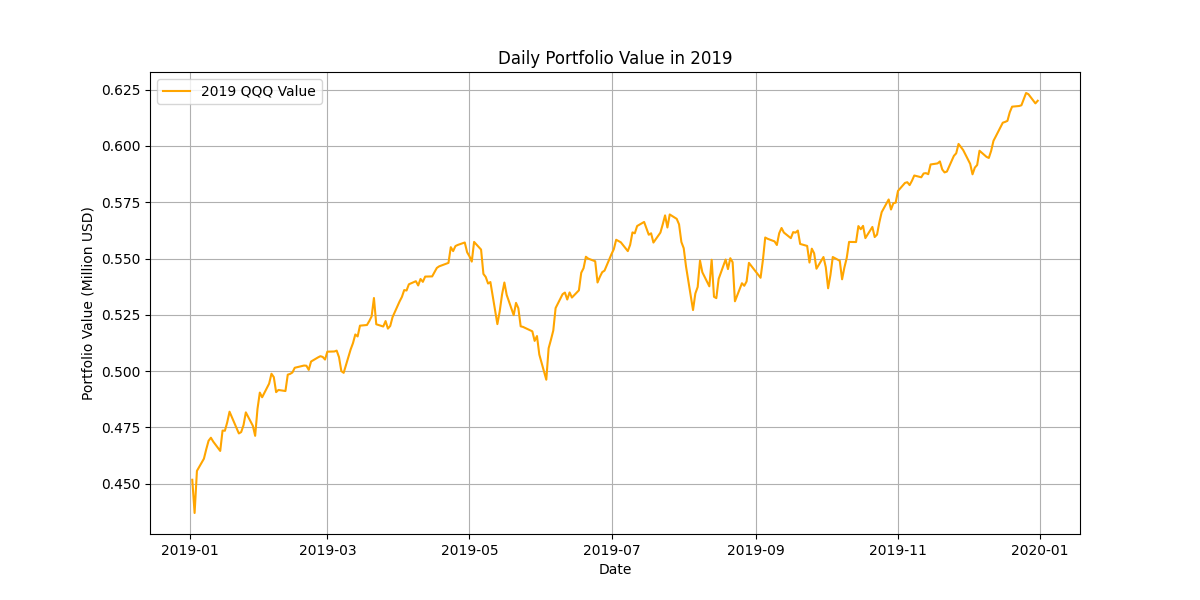

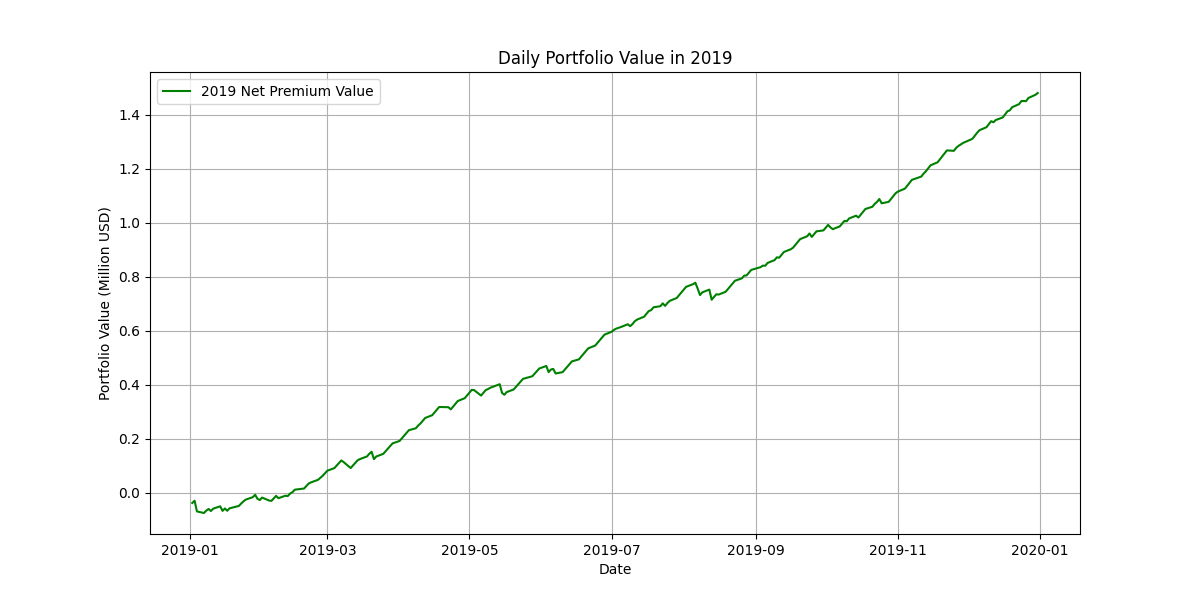

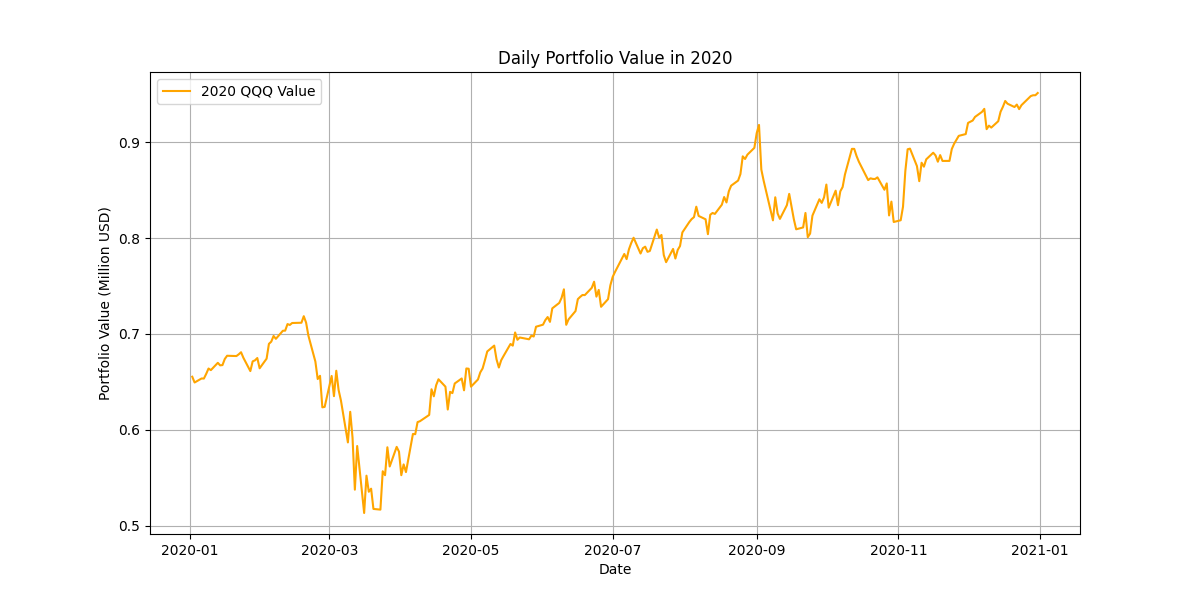

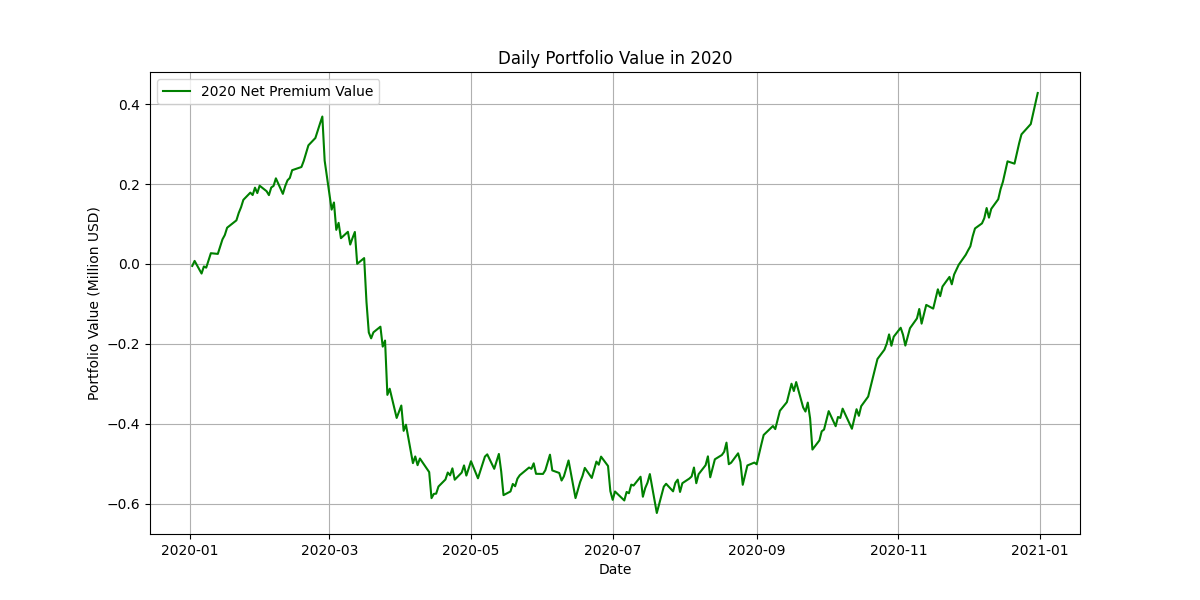

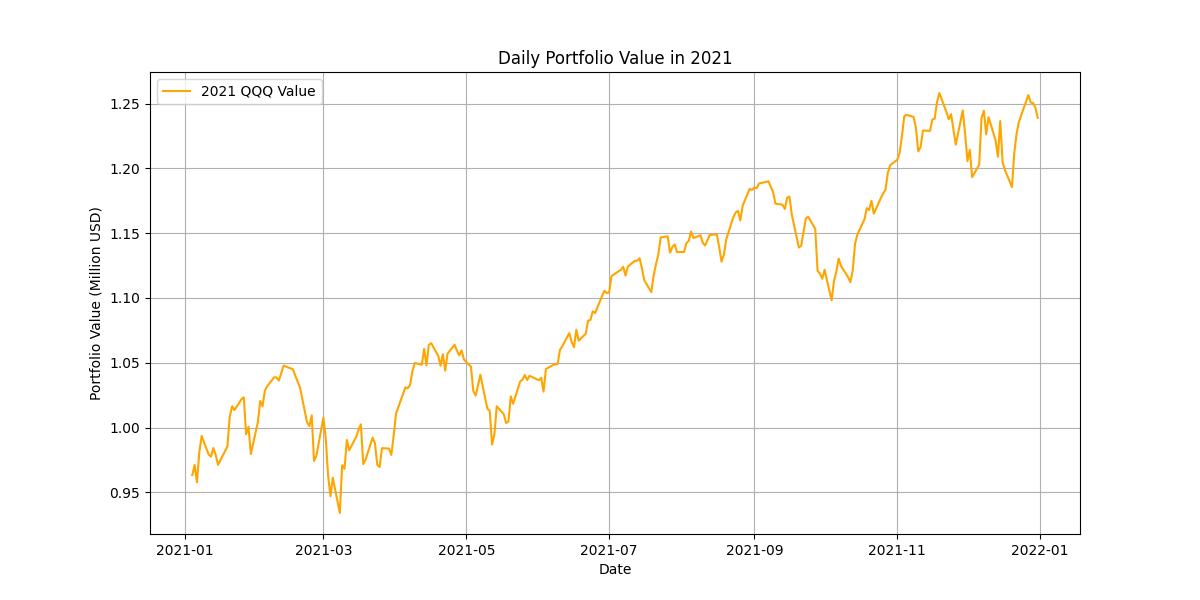

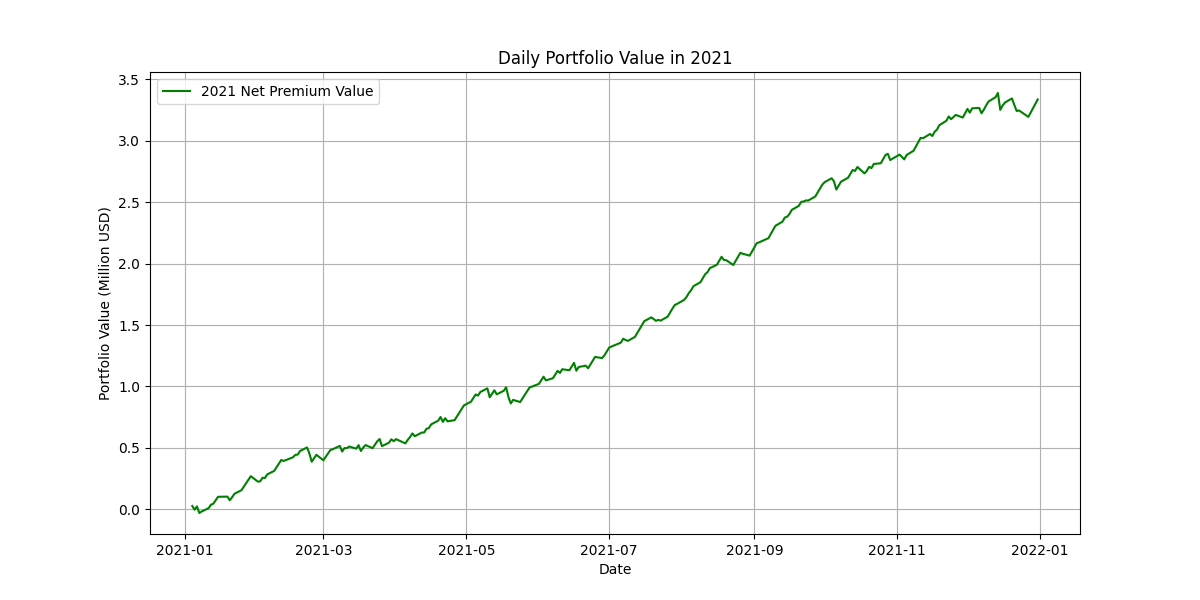

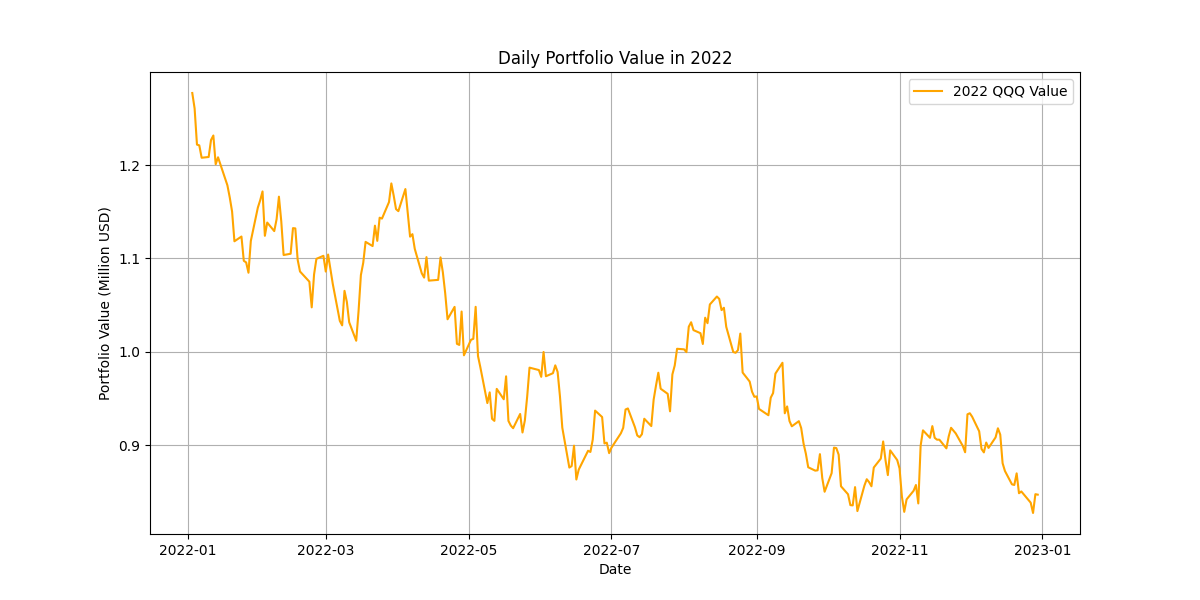

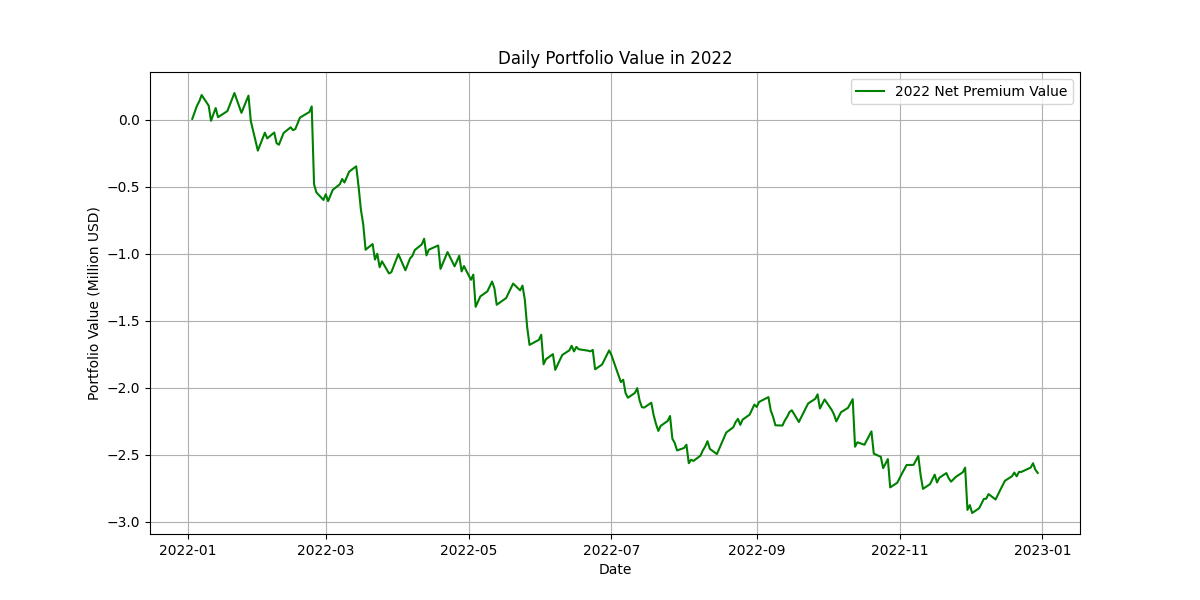

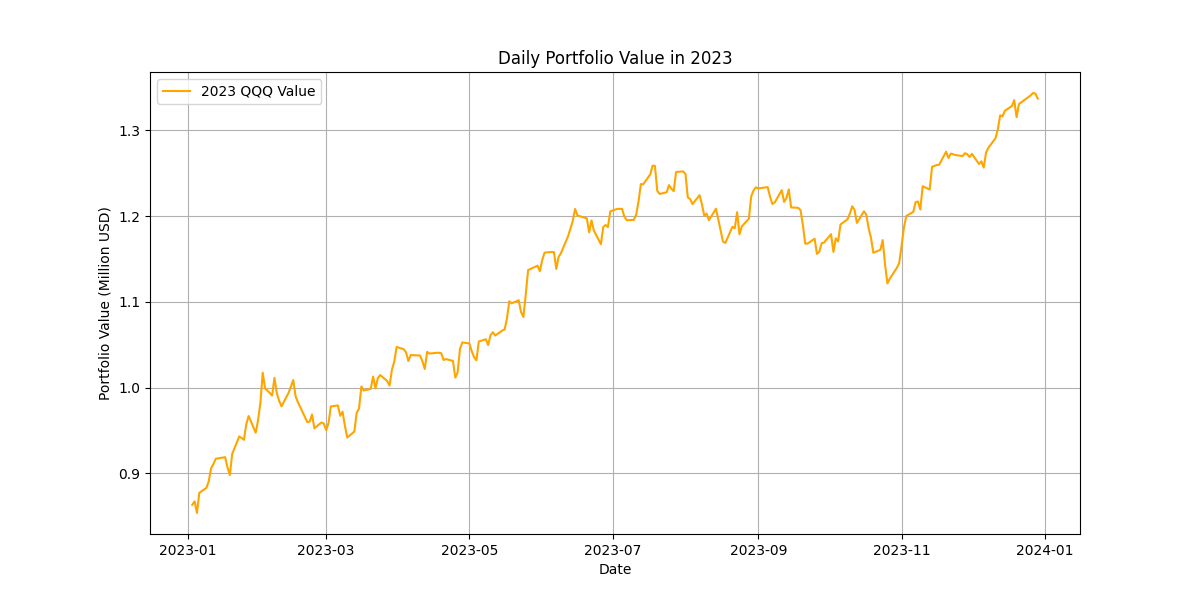

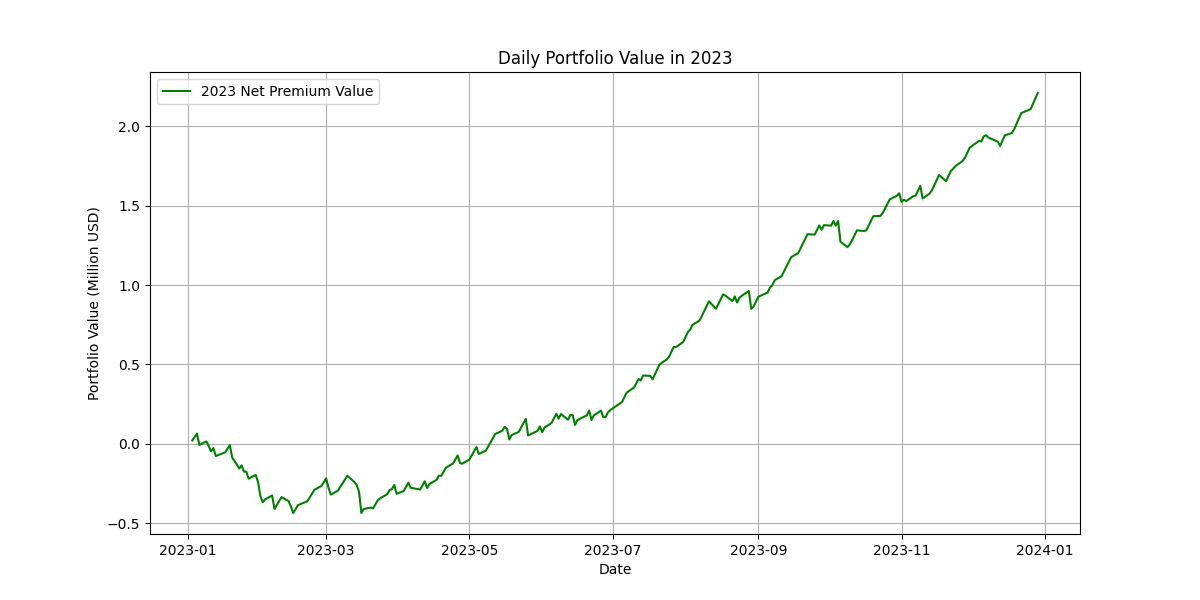

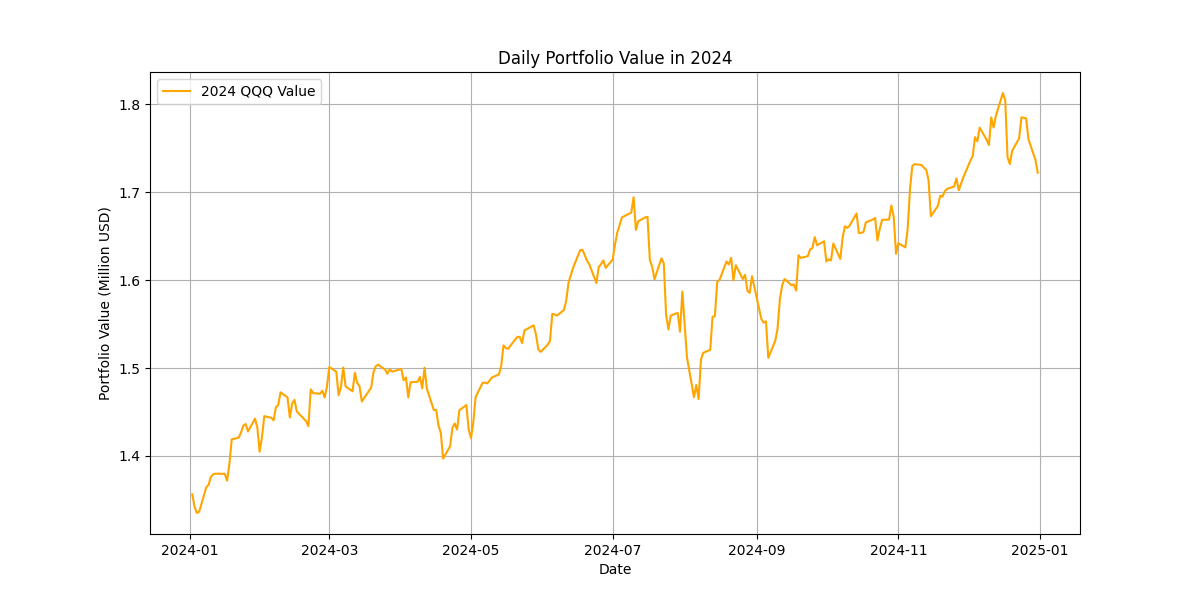

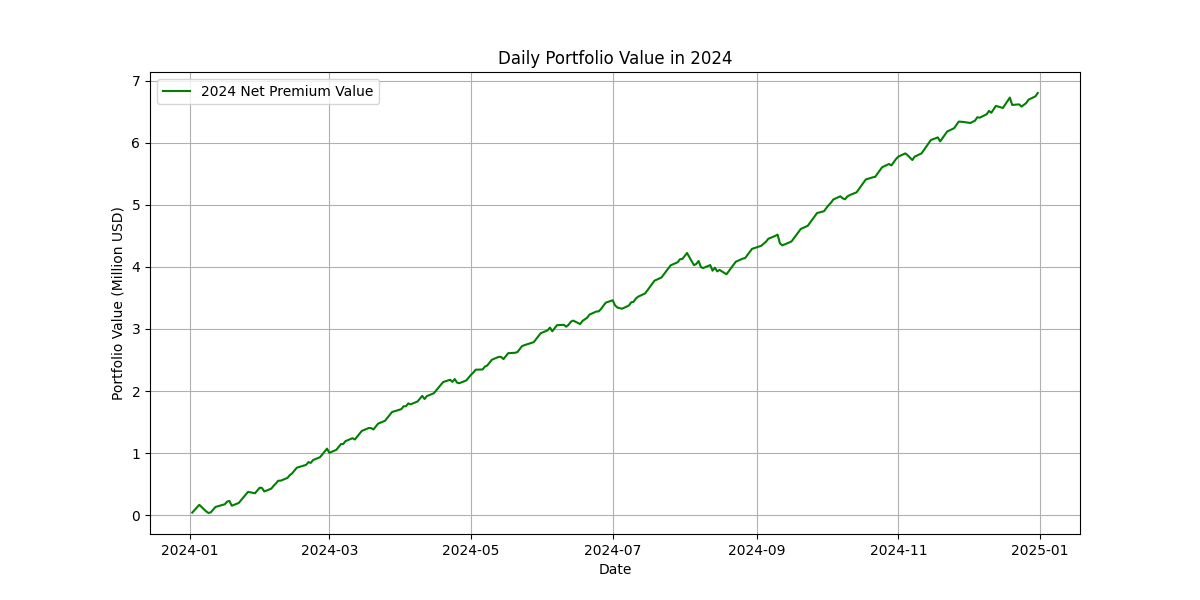

- 10 Years’ Seperated Charts

- Pure QQQ Value & Net Premium

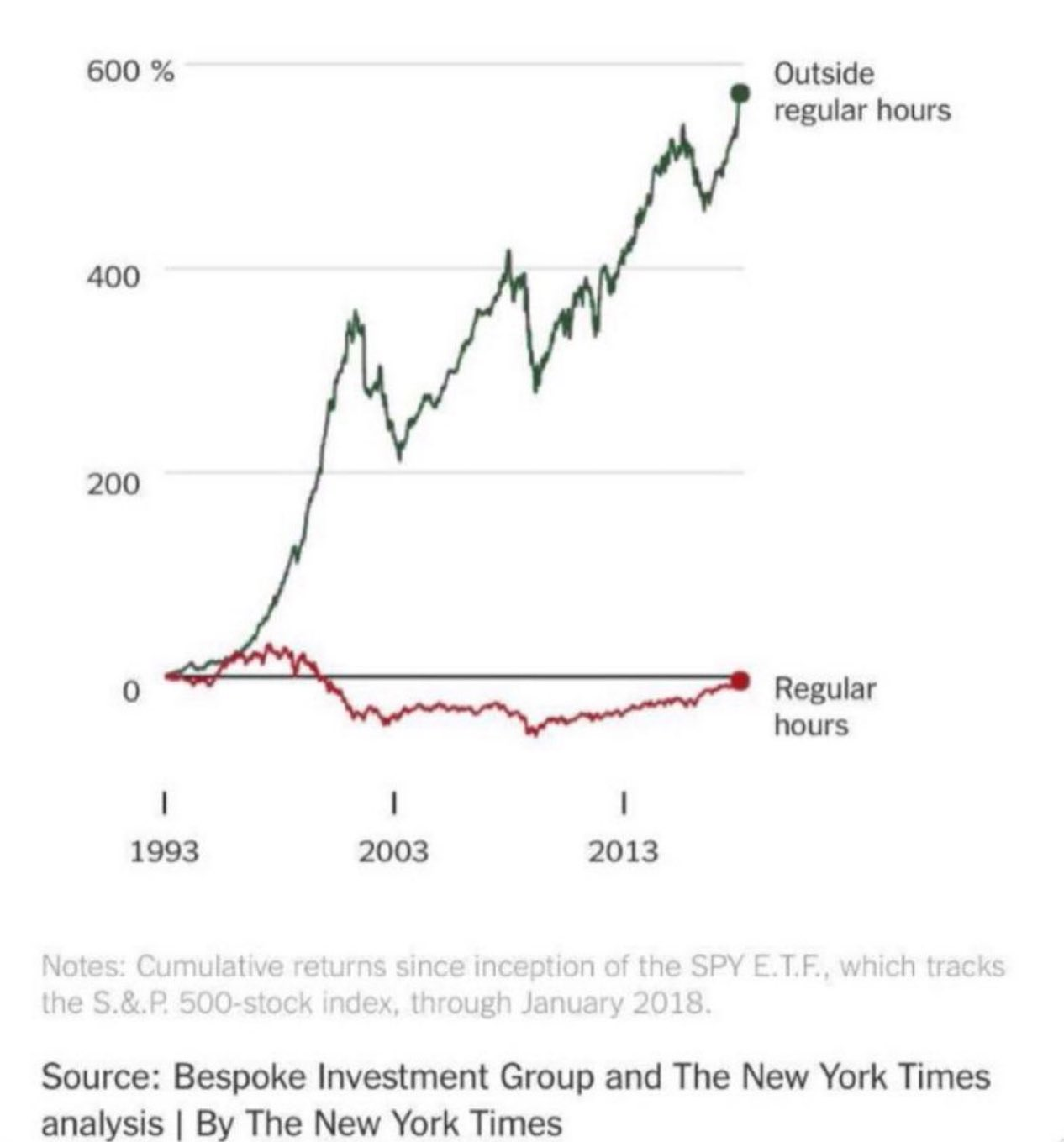

- When the market crash, sell daily call is not a reasonable way to hedge.

- See 2022 as an example.

- Because even in bear market, if we just see the intraday price action, the numbers of red days and green days are not quite different. Lots of downsides happened in pre-market and post-market.

- Using SPY from 1993 to 2018 as an example. The most upside and downside happened in pre-market and post-market.